China’s yuan has strengthened more than 1 per cent so far this week, reaching 6.4604 to the US dollar on Wednesday. Photo: Reuters

The rapid appreciation in the yuan's exchange rate has resulted in capital inflows and given rise to concerns about its effect on exports and China's manufacturing competitiveness, with policymakers making moves this week to curb its ascent.

For now, the People's Bank of China (PBOC), the nation's central bank, has not intervened directly to halt or reverse the currency's appreciation, but instead is relying on a series of measures that are meant to boost the ability of Chinese investors to buy foreign currencies, thus taking some pressure off the yuan.

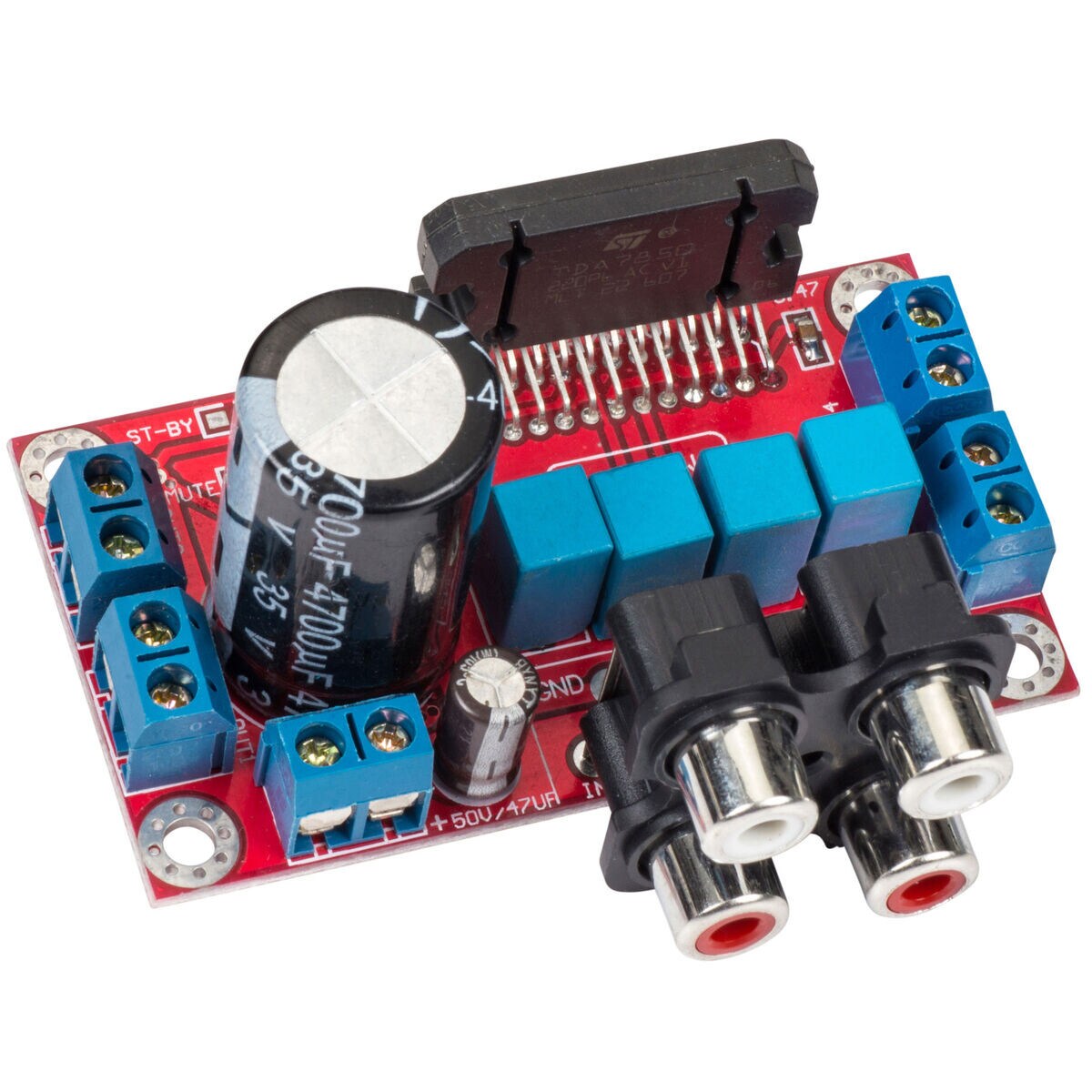

A yuan-ti broodguard. Female yuan-ti lay eggs in brood chambers, marking each clutch with its parentage, then abandoning them to the care of broodguards.Yuan-ti hatchlings are hatched from these eggs, which are always curious and eager to explore, and will seek food immediately, even eating each other if sustenance is not at hand. The terms audio card, audio adapter, and sound adapter are sometimes used in place of sound card. Sound Card Description A sound card is rectangular piece of hardware with numerous contacts on the bottom of the card and multiple ports on the side for connection to audio devices, such as speakers.

Measured by the daily reference rate published by the PBOC, the Chinese currency appreciated 6.3 per cent against the US dollar last year, including 8.5 per cent in the second half. It has further strengthened more than 1 per cent so far this week, with the central parity rate reaching 6.4604 yuan to the dollar on Wednesday - the strongest level since June 2018.

Get the latest insights and analysis from our Global Impact newsletter on the big stories originating in China.

The lower the figure in the US dollar-yuan exchange rate, the stronger the Chinese currency, since it means it takes fewer yuan to purchase one dollar.

The central bank has claimed for some time that it has stopped regular intervention in the foreign market, and has promoted market-driven two-way fluctuations, but its announcement of three new capital-movement measures in the past week suggests growing concern as the yuan's rally continues.

The State Administration of Foreign Exchange (SAFE), the nation's foreign exchange regulator, said on Wednesday that it will prevent disorderly fluctuations in the currency market. It also said it will strengthen monitoring and evaluation of currency market conditions, paying close attention to the impact of external shocks, including the pandemic, according to a statement on its website.

The China Foreign Exchange Trade System (CFETS) lowered the US dollar weighting in its currency basket from Friday, trying to reduce its influence over the yuan exchange rates. That move was followed shortly by a partial relaxation of restrictions on capital flows for cross-border yuan use.

On Tuesday, the central bank raised the ability of Chinese banks under its supervision to increase their overseas lending, which 'will be good to meet the funding demands of outbound investors, help expand the cross-border use of the yuan and balance capital flows', according to a PBOC statement.

The changes announced this week indicate a pivot in the government's attitude towards outflows, at least in part, due to the yuan's sharp rise in the last year.

Because of China's strong economic recovery from the initial coronavirus outbreak, hundreds of billions of US dollars in foreign funds have poured into Chinese financial markets due to their higher returns, reinforcing the yuan rally.

Beijing's fear of large 'irrational' capital outflows of 'hot money' - short-term investments in financial products that can move out of the country rapidly - stems from the massive capital flight that resulted from a stock market rout and the subsequent yuan devaluation in 2015. The government imposed strict capital controls and burned through US$1 trillion - a quarter of its foreign exchange reserves at the time - to eventually stabilise the yuan exchange rate.

The current debate centres on whether the yuan is rising faster than justified by the country's economic fundamentals, which would represent a threat to the economy that must be immediately addressed with strong steps.

Analysts disagree on the overall impact of the yuan rise on the country's exports, but they agreed that the profit margins of many exporting firms will be adversely affected.

'I don't see a huge impact of the current exchange rate, 6.45, on exports,' said Raymond Yeung, a senior economist with ANZ Bank. 'Compared with the previous peak of 6.08 (in October 2013), global reliance on Chinese industrial chains has now become much bigger', meaning export demand is less susceptible to changes in prices.

Chinese exports boomed in the second half of last year, as severe outbreaks in major economies, particularly those of the United States and European Union, created strong demand for personal protective equipment and other supplies to fight the virus, as well as computers and other electronics for the work-from-home movement. The value of November's outbound shipments rose 21.1 per cent from a year earlier to US$268 billion.

'On the contrary, a stronger yuan will be good for imports,' Yeung said. A stronger exchange rate means imports will be cheaper in yuan terms.

The PBOC is continuing to build a more market-oriented, exchange-rate regime while gradually proceeding with the long-awaited opening up of the capital account, Yeung added.

However, Ding Shuang, chief Greater China economist at Standard Chartered Bank, said the yuan's rally had fuelled policymakers' worries that the currency would overshoot its proper level, based on economic fundamentals, and hurt exporters' competitiveness.

'Many exporters have already complained that the rapid appreciation and rising costs are squeezing their profits,' Ding said. 'In the long run, the overvalued currency will affect the country's manufacturing industry.'

Guan Tao, a former division director at the SAFE, and now chief economist at BOC International, attributed the rally largely to the weakness of the US dollar. Moreover, the impact of the rise would hit exporters in the short run, but overall would be less than expected, he projected.

'This round of yuan rally will impact exporters financially, but it won't hurt their competitiveness,' he argued in an article published in the January issue of China Forex, a magazine controlled by the SAFE.

Yuan Sound Cards & Media Devices Driver

To manage foreign exchange risks, Guan proposed reducing US dollar exposure and increasing the share of trade settled in yuan. Only 14.5 per cent of Chinese trade was settled in yuan in the first 11 months of last year, lower than the peak of 26 per cent in 2015.

In the new 2021-25 five-year plan, China's leadership pledged to maintain the manufacturing industry's share of the national economy and vowed to increase its global competitiveness.

Greater challenges could be seen in the second half of this year, when overseas production resumes following widespread vaccinations that should help bring the pandemic under control, analysts said.

Policymakers could take bolder actions to encourage outflows, Ding said, maintaining his baseline forecast that the yuan would strengthen to 6.3 to the US dollar by midyear before retreating to 6.45 at year-end.

Yuan Sound Cards & Media Devices Drivers

To take pressure off the yuan, the government could encourage more greenfield investment in Belt and Road countries as well as allow more financial investments abroad, Ding said.

More Articles from SCMP

This article originally appeared on the South China Morning Post (www.scmp.com), the leading news media reporting on China and Asia.

Copyright (c) 2021. South China Morning Post Publishers Ltd. All rights reserved.